Residency Procedures

Insurance, pensions, and tax

Public medical insurance

Public medical insurance is a mutual-aid system to reduce the burden of medical bills on the sick or injured through cost sharing, and everyone living in Japan is obligated to enroll.

Showing a health insurance card at clinics/hospitals allows the bearer to pay up to 30% of the medical expenses incurred.

Employee Health insurance (Procedures undertaken by companies)

Company employees get enrolled in Employee Health Insurance.

National Health Insurance (Procedures undertaken by the Insurance & Pension Section of the ward office)

Individuals who are under 75 years old and are not enrolled in Employee Health Insurance get enrolled in National Health Insurance.

Medical Care System for People Aged 75 and over (Procedures undertaken by the Insurance & Pension Section of the ward office)

Individuals aged 75 and over as well as people aged 65–74 with certain disabilities get enrolled in this medical care system for the elderly.

-

Enrollment in Social Insurance System brochure in different languages (Japan Pension Service)

-

Social Insurance for Everyone brochure in different languages (Japan Pension Service)

-

Living and Work Guidebook for Foreigners: Medical Services(Immigration Services Agency of Japan)

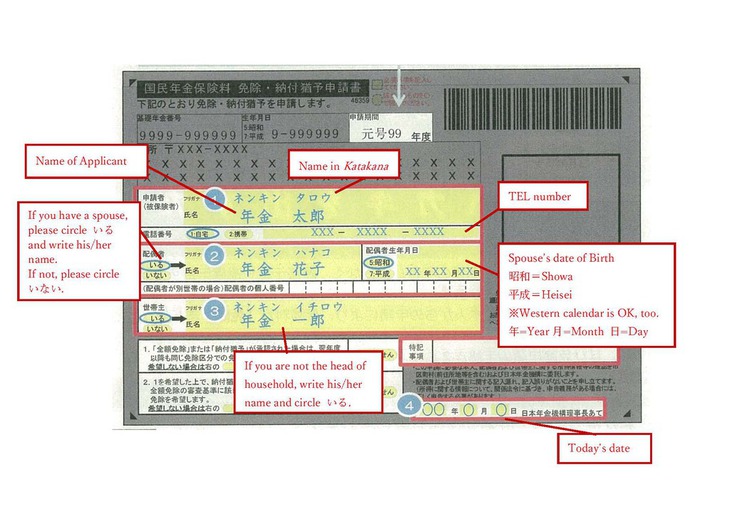

National Health Insurance (for those aged 74 and younger)

Persons eligible for resident registration in Sapporo who are not enrolled in any form of workplace insurance are obligated to enroll in the National Health Insurance Program. Relevant procedures must be undertaken at the Insurance & Pension Section of the ward office that has jurisdiction over the district of your residence.

If your address changes or your baby is born, you must complete the related procedures to update your information within 14 days.

National health insurance card sample

- National Health Insurance Handbookbrochure in different languages (Hokkaido government)

- National Health Insurance Procedures for Foreign Residents (City of Sapporo), Japanese

- Enrollment: Application for National Health Insurance Enrollment(City of Sapporo)

- Insurance premiums: National Health Insurance(City of Sapporo)

- Insurance cards((City of Sapporo)

- Insurance benefits (City of Sapporo)

Medical Care System (for those aged 75 and over as well as people aged 65–74 with disabilities)

Those aged 75 years and older who are eligible for residence registration in Sapporo are obligated to enroll in the Medical Care System.

Individuals who have moved into Sapporo must undertake relevant procedures at the Insurance & Pension Section of the ward office that has jurisdiction over the district of your residence.

- Procedures for foreign residents to enroll in the Medical Care System(City of Sapporo), Japanese

- Enrollment: Medical Care System – Eligibility and procedures related to insurance cards (City of Sapporo)

- Insurance premiums: Medical Care System (City of Sapporo)

- Insurance cards: Procedures related to insurance cards (City of Sapporo)

- Insurance benefits: Medical expenses and allowances(City of Sapporo)

Subsidies for medical expenses

Long-term care insurance system

Under the long-term care insurance system, people aged 40 or older are obligated to enroll and pay insurance premiums. When they need the long-term care, they can use services such as at-home or institutional care, rent assistive devices, and receive placement in welfare facilities for the elderly needing care, by paying part of the cost charged for such services. There are two application methods and different conditions for the use of long-term care services depending on the age of each person: those aged 65 and over are categorized as primary insured persons, and those aged between 40 and 64 who are insured by the National Health Insurance or health insurance programs of their workplace are categorized as secondary insured persons.

Those aged 40 years and older who are subject to resident registration in Sapporo are obligated to enroll in the long-term care insurance program. Premiums are determined based on income.

Unemployment insurance

Pension system

Under the pension system, the insured party pays premiums to receive benefits after retirement and in the event of becoming unable to work due to disability or death, in order to support the livelihood of the insured and their family.

- National Pension Plan (City of Sapporo)

- Japanese National Pension System brochures in different languages(Japan Pension Service)

- Japanese Social Insurance Systems(Japan Pension Service)

- Living and Work Guidebook for Foreigners: Pensions and Welfare(Immigration Services Agency of Japan)

National Pension Plan

All residents of Japan aged between 20 and 59 are obligated to join this basic pension plan. Procedures are performed at the Insurance & Pension Section of the ward office (except for residents from countries exempted by the relevant treaty).

For company employees, government employees and teachers (including their dependent spouse), the employer performs the necessary procedures; such workers do not need to pay premiums individually.

If you are facing financial difficulties, seek advice on possible full or partial exemption from or postponement of contribution payments.

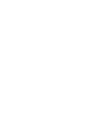

National Pension Contribution Exemption/Postponement(As of Jan.24, 2024)

Japan Pension Service has been sending the letter (envelope: picture) to those who are likely to be eligible for exemption/postponement of contribution.

封筒

There is a postcard part inside and it is the application form for exemption/postponement. Please write your name and phone number. If you have a spouse, you need to write his/her name and date of birthday and so on. There is a sticker to cover your personal info, so put it over and drop into a postbox.

The screening will take about 2 months. The result will be informed by a postcard from Japan Pension Service.

If you are a student, you use Special Payment System for Students (※There are some schools excluded).

If you are a student and have financial difficulty in paying contribution and have not done procedure for this system, please inquire to your school first, or consult at a Pension Office nearby or national pension section of your residential ward office.

- Enrollment: Eligibility and enrollment procedures(City of Sapporo)

- Japan Pension Service - 外国人のみなさま/International

- Application for National Pension Contribution Exemption/Payment Postponementbrochure in different languages (Japan Pension Service)

-

Application for National Pension Contribution Special Payment System for Students brochure in different languages (Japan Pension Service)

-

Q&A (Japan Pension Service)

Employees’ Pension Program

In addition to the National Pension Plan that everyone is obligated to join, the Employees’ Pension Program is also mandatory for those employed by companies, and public servants and teachers. The employer performs the necessary procedures, and premiums are withheld automatically from monthly salaries.

Receiving pensions

Pensions are paid to those aged 65 years or older, those with disabilities, and families of insured parties who have died. Payments are dependent on the fulfillment of fixed criteria including the length of time for which premiums have been paid. For details, contact the pension office.

- Receiving pensions (City of Sapporo)

- Interpretation service for consultations at pension officesbrochure in different languages (Japan Pension Service)

Lump-sum withdrawal payments

Social Security Agreement

All residents in Japan who are between 20 and 59 years old are required to be enrolled in Japanese pension programs. However, if you are already registered under your home country’s social security system, you may be obligated to pay contributions to both countries. Further, even if you contribute to the social security system of the country you are working in, you may not be eligible for benefits if you fail to be covered by the system for a certain length of period (thus failing to satisfy the coverage period requirements). To prevent such problems, there are bilateral social security agreements between Japan and several countries.

Professional seminars for foreign residents

The Sapporo International Communication Plaza Foundation hosts seminars by professionals to provide useful information to foreign residents. Such seminars held in fiscal 2020 were themed on social security, including health insurance and pensions.

- Multilingual Materials (Sapporo International Communication Plaza Foundation), Japanese, English

Tax

People living in Japan must pay taxes regardless of nationality.

- Living and Work Guidebook for Foreigners(Immigration Services Agency of Japan)

- Tax consultations (City of Sapporo)

Municipal taxes

- Types of municipal taxes (City of Sapporo)

- Contacts for tax inquiries (City of Sapporo)

Individual inhabitant tax

This tax is levied on those whose address is in Sapporo as of January 1 and those who live outside the city but own a dwelling or a business place within it. The tax is paid to the City of Sapporo.

- Individual inhabitant tax(City of Sapporo)

- Multilingual information on individual inhabitant tax for foreign residents(Ministry of Internal Affairs and Communications)

Fixed property tax

This tax is levied on those who own land and/or property in Sapporo as of January 1. The tax is paid to the City of Sapporo.

Fixed property tax(City of Sapporo)

Light motor vehicle tax

This tax is levied on those who own a car or motorcycle with an engine displacement of 660 cc or smaller as of April 1. The tax is paid to the City of Sapporo in May annually.

Light motor vehicle tax(City of Sapporo)

Tax manager

If you have trouble paying taxes such as individual inhabitant tax and fixed property tax due to situations such as moving to another country, you must submit a notification of the tax manager you have designated to the municipal tax office. Your tax manager will be in charge of managing tax affairs in your place.

Submission of a Notification of Tax Manager (for individual municipal tax) (City of Sapporo), Japanese

Prefectural taxes (e.g., enterprise tax, automobile tax)

- Overview of prefectural taxes (Hokkaido government)

- Contacts for prefectural tax inquiries (Hokkaido government)

National taxes (e.g., income tax)

- National Tax Agency website

- Call center (National Tax Agency), English

- Facilities – National taxes, prefectural taxes, and municipal taxes(City of Sapporo)

- How to apply for Tax Payment Certificate using your smartphone (National Tax Agency)

Filing a final income tax return

In this procedure, you calculate your income earned over the one-year period from January 1 to December 31 and your income tax and special income tax for reconstruction to be levied on this income and file a final income tax return by the due date to verify any excess or deficiency in the withheld tax. For those employed by a company, the company performs the calculations. Those who are self-employed or have earned income other than that from a salary must file a final income tax return with the tax office. Final returns and a related handbook are distributed at tax offices, and can be downloaded from the National Tax Agency’s website.

The Sapporo Help Desk for Foreign Residents hosts free professional consultation sessions and tax return consultation sessions by certified tax accountants.

- Free professional consultations

- Final income tax return (form) (National Tax Agency), Japanese

- Income Tax and Special Income Tax for Reconstruction Guide (National Tax Agency)Japanese, English

- How to create a final tax return for online (National Tax Agency) Japanese, English, Chinese, Vietnamese

- Individual income tax (National Tax Agency)

- Withholding tax(National Tax Agency)

- Outline of Japan’s Withholding Tax System Related to Salary(National Tax Agency)

- For Those Applying for an Exemption for Dependents, etc. with Regard to Non-resident Relatives(National Tax Agency)

- Application forms (e.g., Application for (Change in) Exemption for Dependents of Employment Income Earner)(National Tax Agency)